The CFPB is still standing … barely. But is it doing anything?

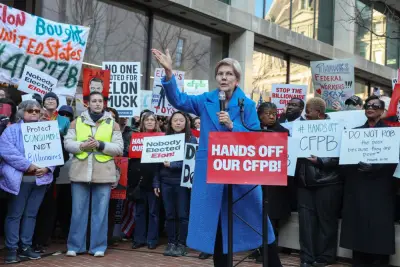

By Rick VanderKnyff NerdWallet CFPB RIP was Elon Musk s tweet on Feb when the billionaire was slashing his way through federal agencies at the behest of his then-ally President Donald Trump Rohit Chopra former director of the Consumer Financial Protection Bureau had been fired Feb By Feb new acting director and also new Treasury Secretary Scott Bessent had ordered CFPB staff to stop all rule-making and enforcement actions among other sessions A second acting director Russell Vought who also leads the Office of Management and Budget under Trump took over the agency days later Vought was a co-author of Project the conservative governing blueprint which stated that the next conservative President should order the immediate dissolution of the agency Congress established the CFPB with the Dodd-Frank Act in in the wake of the economic problem One of its goals was to strengthen and consolidate consumer protection powers that had been spread across multiple executive agencies and the bureau was structured to be shielded from political interference The consumer bureau s statutory obligations are designed to make markets for consumer financial products and services work in a fair transparent and competitive manner Sen Elizabeth Warren who was instrumental in the bureau s formation wrote in Since its creation the watchdog agency has brought about the return of more than billion to more than million consumers who were discovered to be casualties of malfeasance by financial organization companies Republicans and countless banking personnel though have long accused the agency of overreach Criticism spiked under Chopra s leadership during former President Joe Biden s administration In a letter to Chopra members of the Senate Committee on Banking Housing and Urban Affairs called the CFPB a lawless and unaccountable agency that was pursuing a radical and highly-politicized agenda unbounded by statutory limits The Project Mandate for Leadership in calling for the CFPB s elimination characterized it as a shakedown mechanism to provide unaccountable funding to leftist nonprofits politically aligned with those who spearheaded its creation In the weeks after Trump s return to the presidency it looked like critics might decisively see the agency fully dismantled But the agency still stands at least in name Its immediate and long-term future remain cloudy at best however to the concern of consumer advocates We are at a pivotal moment for all that was all that has been and what could be says Amanda Jackson director of consumer campaigns for Americans for Financial Improvement a nonprofit group focused on financial equity The CFPB has done tremendous work since its inception We re seeing the agency pull back from prior commitments and that hurts everyone Jackson continues So it is a concerning moment It s what we spend a lot of time calling attention to the integrity of the bureau the fact that the bureau has done so much work and all that we are seeing is being chipped away The CFPB media office did not respond to multiple requests for comment from NerdWallet What s keeping the CFPB on life backing Soon after Trump took office the CFPB issued layoff notices to more than staffers which would have left a staff of about The CFPB s union rapidly filed suit to block the action and in April a U S District Court judge paused the layoffs The Trump administration expeditiously appealed the ruling For now the pause remains in place In May the U S Supreme Court rejected a challenge to the CFPB s funding mechanism reversing an earlier decision by an appeals court in Louisiana When the CFPB was established Congress opted to have it funded via allocation from the Federal Reserve This was a move to shield it from politicization in the annual congressional budget cycle But critics have long called the funding mechanism unconstitutional Related Articles Requested on Reddit How do I recover from a big money mistake Grad school debt holding you back How to get it under control major participant loan changes from Trump s budget bill Next procedures for borrowers For a few employees development benefits such as tuition assistance prove life-changing Ready to retire in years Here s your checklist Congress did manage to trim the bureau s funding cap by almost half in the big beautiful bill passed and signed into law in early July The bill cut the CFPB s available funding to of the Federal Reserve s operating expenses down from the limit that has been in place since the agency s founding The cut has no immediate effect as CFPB s current leadership has shown no inclination to request funding even at the new limit and at one point explored returning the bureau s current balance to the Federal Reserve But the cut will hamstring the ability of future administrations to restore the CFPB s previous regulatory and investigative functions Slashing the CFPB s budget nearly in half will severely compromise its ability to stand up for consumers and take on big banks and unscrupulous financial firms when they cheat working families out of their hard-earned money disclosed Chuck Bell advocacy operation director at Consumer Reports in a prepared comment Meanwhile House Republicans forwarded bills aiming to limit numerous aspects of the CFPB s work and more broadly aspects of the Dodd-Frank Act that created the bureau Americans for Financial Reorganization helped organize opposition to the decree with a detailed letter signed by civic and population organizations and in the end the bills did not advance before the House went into summer recess So the wins are incremental but they are there Jackson of Americans for Financial Revision says What about the consumer complaint database By statute the CFPB receives and responds to complaints from consumers about financial products and services To date the CFPB has received more than million complaints in and all signs indicate that CFPB staff continue to monitor and respond to these complaints The CFPB site shows the following status for complaints filed through July Closed with explanation Closed with non-monetary relief Closed with monetary relief In progress Untimely response Those percentages are roughly in line with figures revealed for The complaint database is still functioning says Jackson It is something we too are trying to make sure remains functioning We have not heard of reports from actual consumers that counter that But the status of the complaint process and database is something her organization is monitoring The CFPB began receiving and acting on consumer complaints in Complaint volume began to accelerate during the pandemic and continues to spike in Volume did drop temporarily in February of this year after the CFPB posted a error on its home page for several weeks at the behest of Vought but recovered in March The vast majority of complaints to the CFPB in involve credit reporting mirroring figures in What else has the CFPB done in The more appropriate question might be What has the CFPB undone Under Vought the CFPB has dropped numerous lawsuits against financial services companies Those cases were dismissed with prejudice which means the CFPB forfeited the right to sue over the same asserts again in the future This has included cases against such companies as payment company Zelle and three of its owners Bank of America JPMorgan and Wells Fargo Capital One learner loan servicer Pennsylvania Higher Tuition Assistance Agency and credit reporting agency TransUnion The greater part lately on July the CFPB moved to withdraw from a million settlement reached in with Navy Federal Credit Union related to overdraft fees Under the settlement the credit union would have refunded million to affected organization members in addition to paying a million fine This came despite an April memo to staff stating that the bureau would focus its enforcement and supervision guidance on pressing threats to consumers particularly organization members and their families and veterans That memo disclosed that the agency would refocus its attention on banks and other depository institutions rather than nonbanks The memo also revealed the agency would deprioritize clinical debt scholar loans digital payments and peer-to-peer platforms and lending areas that the Biden-era CFPB had focused on In May the CFPB took a slew of actions to rescind rules set under the previous administration and to withdraw more than guidance documents including protocol statements and advisory opinions certain of which dated to the bureau s inception Other earlier CFPB rule changes have been undercut by court decisions and congressional action including a rule finalized in the waning days of the Biden administration but never put into effect that would have banned the inclusion of health debt on credit reports A judge ruled against the medical-debt ban on July likely sealing its fate The CFPB under Biden had also finalized a rule to limit the overdraft fees that banks can charge Likewise the rule never went into effect and was reversed in April by Congress And the CFPB had moved in May to treat Buy Now Pay Later lenders as credit card providers extending greater protection to consumers of those products The current CFPB publicized in May that it would not prioritize enforcement actions against BNPL providers On July the current CFPB did announce a settlement with FirstCash Inc a pawnshop operator which is alleged to have issued loans exceeding the maximum annual rate of Under the agreement the defendants will pay million to the CFPB victim s relief fund and set aside an additional million to address future indicates The CFPB still has no permanent director Trump had nominated attorney Jonathan McKernan in early May but withdrew the nomination days later Vought continues to serve as acting director What does it all mean for consumers For now at least the CFPB s complaint database remains a viable way for consumers to address issues In addition states may pick up particular of the work that the current CFPB is walking away from In the end though consumers may need to do more to advocate on their own behalf as federal oversight of the financial services industry erodes Jackson worries however that the diminution of the CFPB s watchdog role will fall hardest on communities that are already at greater peril of financial predation I want to name what that means for communities of color and our military personnel Jackson says This attack on the bureau is an attack on those people More From NerdWallet Procedures to Become Your Own Consumer Advocate Petitioned on Reddit How Do I Recover From a Big Money Mistake The Broke Black Girl I Budget for Enjoyment No Matter What Rick VanderKnyff writes for NerdWallet Email rvanderknyff nerdwallet com The article The CFPB Is Still Standing Barely But Is It Doing Anything originally appeared on NerdWallet